Lots of folks are hyperventilating about the possibility of a trade war with China. I see this as a result of wide-spread misunderstandings about the economics of trade between countries.

So let me start from the basics. There are three and only three ways to create wealth. What is wealth? It is the stuff that we use, that we eat, that we build with. Cars. Medicines. Clothing. Tools. Vegetables. Oil. Fish. Electronics. And there are only three ways to create them.

1) We can grow wealth. Start a farm. Get seeds and begin growing vegetables in the backyard. Plant acres of trees.

2) We can extract wealth from nature. Dig an oil well. Go fishing. Cut down trees. Mine for gold.

3) We can manufacture wealth. Build a car manufacturing plant. Knit sweaters. Build houses. Make electronic gear.

Let me refer to these three ways to create wealth as “farms, fishing boats, and factories”. And of these, the most important is manufacturing—you cannot generally triple the amount of food from an acre, or triple the amount of oil coming from a well.

But you can triple the output of a factory without breaking a sweat—so manufacturing should be looked after and cared for and promoted at every opportunity.

Everything else is services—bankers, barbers, bookkeepers, surgeons, stylists, singers. They are important, some are life-and-death important … but they don’t create any wealth.

Now, if a country is smart, it will do everything it can to build and strengthen the part of their economy that is “farms, fishing boats, and factories”. Unfortunately, somewhere around 1985, the US got really stupid and bought into the “free trade” and “globalism” fairy tales … and since then, our manufacturing sector has gone to hell.

And why not? When a company can move a factory to Mexico and pay their workers $3 per hour with no workmen’s compensation insurance and no tariffs when they sell their goods in the US, why not? They’d be foolish to do anything other than move … and as a result, the “Rust Belt”, the industrial heart of our country is either dying or dead. With the factories gone to Mexico and China, the towns have nothing to keep them going.

Signing on to agreements like the North American Free Trade Agreement (NAFTA) and the World Trade Organization (WTO) is one of the stupidest things that the US has ever done … and it has cost us greatly. Here’s Presidential Candidate Ross Perot, who like President Trump was a businessman rather than a politician, speaking very presciently on the subject in his inimitable style:

Now, this objection to “free trade” and “globalization” is not a new idea. In 1684, an economist named Philipp von Hörnigk wrote a short essay with the lovely title of “Nine Points on How to Emulate the Rich Countries”. Here are some of his prescriptions for how a country gets rich, recommendations that are even more important today than they were in 1684. First, here is his recommendation about manufacturing. In all cases, the emphasis is mine:

… all commodities found in a country, which cannot be used in their natural state, should be worked up within the country; since the payment for manufacturing generally exceeds the value of the raw material by two, three, ten, twenty, and even a hundred-fold, and the neglect of this is an abomination to prudent managers.

Manufacturing is the easiest way to produce wealth, and thus we should do it ourselves and not farm it out overseas.

And that long ago, Philipp foresaw the huge trade deficits that our economic stupidity have brought us:

… the inhabitants of the country should make every effort to get along with their domestic products, to confine their luxury to these alone, and to do without foreign products as far as possible (except where great need leaves no alternative, or if not need, widespread, unavoidable abuse, of which the Indian spices are an example).

Unfortunately, we have ignored this excellent advice and addicted ourselves to foreign products. He goes on:

… in case the said purchases were indispensable because of necessity or irremediable abuse, they should be obtained from these foreigners at first hand, so far as possible, and not for gold or silver, but in exchange for other domestic wares.

In that paragraph, the author is warning against running up a trade deficit as we have foolishly done. He says that we should sell the same amount of goods overseas as we buy. He then says

… such foreign commodities should in this case be imported in unfinished form, and worked up within the country, thus earning the wages of manufacturing there.

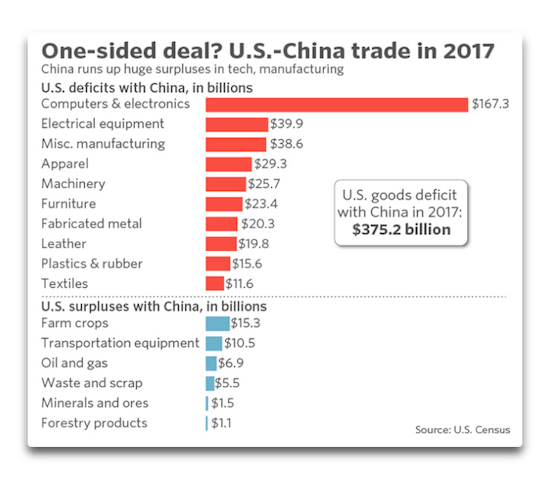

Sadly, we are doing the exact opposite of this excellent advice—we are exporting raw materials and importing manufactured goods, and rather than US workers, the Chinese workers are “earning the wages of manufacturing”. Here is the sad record of our current trade deficit in goods with China:

We are sending raw materials to China, importing manufactured goods, and wondering where our manufacturing jobs disappeared to … this is the exact opposite of Philipp von Hörnigk’s excellent advice. He said (emphasis mine):

…opportunities should be sought night and day for selling the country’s superfluous goods to these foreigners in manufactured form, so far as this is necessary, and for gold and silver; and to this end, consumption, so to speak, must be sought in the farthest ends of the earth, and developed in every possible way.

A country gets rich and stays rich by importing raw materials, manufacturing goods from the raw materials, and selling them as widely as possible … just as we used to do, and as China is doing today.

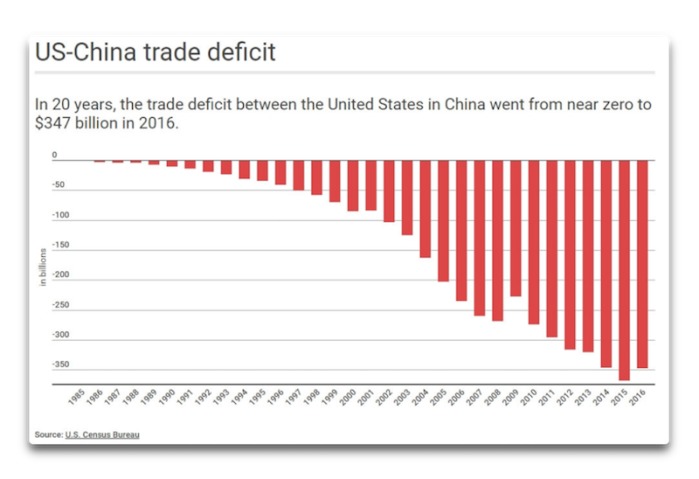

At present, as the graph above shows, we are sending about a third of a trillion dollars to China every year … and we wonder why their economy is booming? We fret and fuss because a border wall might cost twenty billion, and meanwhile, we are foolishly pissing nearly twenty times that amount down a Chinese rathole every year.

So let me bring this back to the title. I have no fear of a trade war with China, because the worst-case scenario of a trade war is that all trade between the two countries stops entirely … and that will put a third of a trillion dollars back into our pockets every year, year after year. In addition, it will totally revitalize our moribund manufacturing, because we will have to do what Philipp von Hörnigk recommended—live off of what we produce ourselves.

People object to this, however, saying things like “How can the poor consumer live without cheap Chinese goods?” But the reality is, if your factory just closed down and you are out of a job, cheap Chinese goods mean nothing. Next, that ignores the billions and billions of dollars that will be spent in the US and not overseas.

And there is a third consideration. Look at the history of our trade deficit with China:

Thirty years ago we had no trade deficit with China, or with Mexico for that matter, and our economy worked just fine. But then we signed on to NAFTA and the World Trade Organization, and just as Ross Perot predicted, we killed our manufacturing sector. Here’s the history of our trade with Mexico:

See when we went off the rails? As soon as we signed on to the NAFTA agreement. And here’s the history of our trade deficit with the world.

Note that our stupidity is currently costing us two-thirds of a trillion dollars per year, half of which is going to China.

So my third point is that a trade war is not dangerous to us because, as you can see, as recently as the 1980s we didn’t have a trade deficit with China, Mexico, or the world … and we got along just fine.

And since this is the worst-case outcome of a trade war, I would be overjoyed to see a trade war start. We are the suckers in this global game, and as a result, a trade war can only make our position better.

This is also the reason why our trading partners are screaming so loudly about the possibility that we might impose tariffs on their goods … because we are currently the losers and they are currently the winners in the deal. That means that they can only lose in a trade war, so of course, they’ll oppose tariffs with all their might … and we can only gain in a trade war. The fact that our economic competitors hate the idea of US tariffs is solid evidence that such tariffs are a very good idea.

Finally, here’s what passes for the “free trade” that everyone is so hyped up about.

The European Union charges a 10% tariff on all cars that come from the US.

China charges a 25% tariff on cars from the US.

And us? We’re the pathetic idiots in the game. We charge a pathetic 5% tariff on the importation of foreign cars … and people call this “free trade”??? Of course the EU and China don’t want us to rock the boat—they’re taking us for fools and they don’t want to stop.

The President is 100% correct. Our trade deals are a pathetic joke. We need to renegotiate all of them, we need to stop importing goods that we can manufacture here, we need to follow the excellent recommendations of Philipp von Hörnigk from 1684, and we need to impose tariffs on a wide variety of imported goods.

Which is why I say, bring on the trade war! It can only do us good, and it might just save us two-thirds of a trillion dollars per year. What’s not to like?

In closing, my best regards to each and every one of you. Hug your families, tell your friends that you appreciate them, walk in the rain, play in the sunshine, life is far too short …

w.

FURTHER READING: I was a strong advocate of free trade until I read How Rich Countries Got Rich and Why Poor Countries Stay Poor. Erik Reinert lays out all of these points far better than I. I cannot recommend this book too highly. If you want to shed your economic innumeracy, this is the book that will do it.

Willis, thank you for this article. Could you please make a comment or two about the counter argument that if we, say, cut off manufactured goods coming from outside the US, then the cost to the consumer in the US will increase dramatically? I’m thinking of situations like Japan where the cost of living is so ridiculously high because of protectionistic trade policies. Thanks. Victor

LikeLike

First, cheap goods are meaningless when your factory has been shipped to Mexico and you are unemployed.

Second, as Philipp von Hörnigk said in 1684

See my post “True Wealth” for further discussion of this idea.

w.

LikeLike

“farms, fishing boats, and factories” . ‘Fisheries’ might be a snappier alliterative synonym.

There are other factors favouring wealth creation, although not in themsleves wealth in the sense you use: education, infrastructure, communications, record-keeping, a legal system, police…but I do see what you mean. It wasn’t until England started industrialising in the 18th C that it became a world power.

LikeLike

Willis,

On a trip to the northwest last August I was stunned by the amount of timber (raw logs) decked along the Columbia river. From Astoria all the to Vancouver our national wealth was being bled out to be shipped over seas to be sawn and planed into lumber. Meantime trainload after trainload of Canadian lumber rolls into the US on a daily basis. How many sawmills have closed? How many lumber towns have disappeared? How many sustainable jobs have been forfeited on the hideous altar of free trade?

When I worked on a farm for a time, the common wisdom was that every farm dollar was spent seven times before it left the local economy. I expect that local lumber mills would exhibit a similar economic boost. And instead we load the trees on a foreign ship to be multiplied in value in another country while we subsidize those who have lost their jobs here.

Thanks for the great piece.

pbh

LikeLike

Interesting analysis, Willis. Warding off foreign-made goods with tariffs might well bring back some manufacturing into the US, but at much higher prices, thus reducing aggregate demand. In general, reduction in aggregate demand is not a good thing for an economy. I’m not a sufficiently sophisticated economist to judge how that all works out in terms of overall economic health. Much to ponder.

In theory, though, exporting lower-technology/ lower value goods should allow the US to have more capital and labor available for higher technology and higher value manufacturing (e.g., chip design, heavy equipment, aircraft, pharmaceuticals, etc.). In theory, that should benefit the economy…if labor can be re-purposes to these requirements and if the global aggregate demand for such goods is sufficient for full employment.

Since graduate school (business/ economics studies) bought into the “free trade” argument that free trade allocates capital, labor, and entrepreneurial activity in the most globally efficient manner…and that an optimally efficient global economy benefits all. That was an easy theory to accept when the US, as a sovereign, was far stronger and economically more successful than any other sovereign. Now, with a significant portion of our wealth having been attritted away to China and the Middle East, I, like you, have re-thought the premises and implications of such an approach on our economic and societal health, and am left wondering.

Thanks for the book reference.

LikeLike

Reblogged this on HiFast News Feed.

LikeLike

Excellent job Willis! Most folks just can’t get past a headline and into the math of things now days.

I had a discussion a while back with one of those folks on a similar subject. The $15 an hour wage item for unskilled workers. Walmart was in his sights. He insisted that they should make that $15 item happen, and at the same time keep prices low for him, and also keep the stock price high for him as a stock holder. I told him he was talking out of 3 sides of his mouth and to take a course on basic economics.

LikeLike

I figure if a $15 minimum wage is good, that we could end poverty forever by just setting the minimum wage at $75 per hour …

w.

LikeLike

Just from memory, I read a long time ago pointed out something similar to what you say. The countries who primarily export raw materials (think third world) are way poorer than those that export value added goods (think first world).

International companies are another problem. Why would they care if we have a trade deficit? They’re going to do what serves themselves.

Free Trade is an illusionary feel good term like communism. About as real as free lunch (TANSTAAFL). Japan plays the game by creating importation rules that make is difficult to bring products into the country. Just something as simple as a baseball glove wouldn’t meet their standards at one point. Top that off with the interlocking nature of their companies and you have only a trickle of things getting in. Oh, and notice that companies like Sony buy our companies but I doubt that the reverse is true. Countries like China and Viet Nam also aren’t likely to allow US companies in and if they do they’ll always be in danger of losing their assets if the rulers decide to take them.

One area of trade that you didn’t address is the intangibles. This doesn’t affect the average American but it does relate to trade. By intangibles I mean things like software and media. American movies and computer software are big overseas but employ a relatively small part of populace here for example. How much of that money actually comes back here? Those items would show up on the plus side of the balance sheet but I doubt if they are more than a drop in the bucket.

LikeLike

I think that the key in these discussions is who benefits from the kind of trading agreements the USA entered where goods from China and other nations come into the USA practically tariff free or with much smaller tariffs than other countries charge American goods. The investor class in the USA has benefitted from that enormously. They got to profit from low labor costs in China and practically no environmental controls while being able to sell in the USA market. So, many previously USA manufacturers became importers in fact. A few years ago I remember LOLing on hearing a presenter in CNN referring to Matel as an American manufacturer with manufacturing facilities overseas! Given that Matel, even then, didn’t manufacture anything in the USA that was clearly an awkward way of obscuring the fact that this company had become simply an importer which holds some patents. Clearly Chinese workers also benefitted with hundred of millions being lifted from abject poverty. But the price paid by the USA working class was very heavy as well as the price paid by the governments at all levels in the USA. No wonder that the economic elites in the USA went all “globalist”! At the same time the deliberate decision not to do anything about illegal immigration and the legal importation of highly skilled labor from abroad by tech companies is a nice (from a “globalist” point of view) complement: it keeps pushing labor costs in the USA down. Thanks for a lucid discussion of this situation.

LikeLike

Thanks, Dalcio. Welcome to the blog.

w.

LikeLike

I have two philosophical points to make that do not necessarily affect your main argument, but still may be of interest:

1) There is a fourth way of creating wealth: trade / exchange. Say, you have a pack of chocolate but you hate chocolate, while you absolutely love gummy bears. You meet somebody with the inverse set of likes and dislikes. So, you exchange your sweets, and each one has created wealth, where it had not been available to him before.

This leads me to the definition of wealth: The essence of wealth is the ability to satisfy a desire (at one’s discretion). The successful fulfilment of a desire may be classified as a gain, a benefit or an advantage vis-à-vis a state of affairs, when no such fulfilment has been accomplished.

By extension then “creating wealth” refers to an act that provides one with “a gain, a benefit, an advantage” ( i. e. results of the fulfilment at one’s discretion of a desire/desires).

2) On these grounds, I would challenge your thesis:

“Everything [except the above three ways of creating wealth] else is services—bankers, barbers, bookkeepers, surgeons, stylists, singers. They are important, some are life-and-death important … but they don’t create any wealth.”

Services like cutting somebody’s hair do create wealth. For instance, assuming a “normal” human being, if I [or a doctor] manage[s] to heal my broken little finger, I have been provided “with a gain, a benefit, or an advantage” that I have strongly desired and whose immediate provision at my urgent discretion represents a capacity that we call wealthiness. I suspect, most wealth creating services may be classified with other forms of manufacturing.

LikeLike

Georg Thomas says:

Clearly you are not an accountant. Since I am one, I can assure you that trading assets does NOT create wealth. If I give you $100 worth of coffee and you give me $100 worth of tea, there is no wealth created. Ask your accountant, or the IRS, if you don’t believe me.

You also say:

I’m sorry, but that is not true. To understand this, suppose there are two couples on a tropical island. One person fishes, one has a garden, one gathers food and building materials from the forest, one makes clothes from local fiber. They could go on for a long time that way, they are creating real wealth. They will live in comfortable houses, and eat and dress well.

But suppose on the next tropical island there are two couples, and one person is a barber, one is a doctor, one is a journalist, and one is a musician, noble occupations all but services all … that society will have nothing to eat, nothing to wear, nothing to keep them from the rain. They will starve to death naked outdoors. None of those occupations create wealth, while all of the activities on the first island all do create wealth.

Best regards,

w.

LikeLike

Thank you for your answer.

I am puzzled.

First you argue wealth is what your accountant or the IRS tells you what it is. Then, you arbitrarily and needlessly impoverish the term “wealth” by equating it with “indispensable requirements for basic survival”. Even your accountant has a broader notion of wealth than you do.

What do you not like about my wider definition of wealth?

Different people have different notions, different classifications of wealth. While the accounting classification may or may not overlap with other classifications (such as mine), it does not invalidate the logic of my reasoning: chocolate does not represent a (wealth-establishing) benefit to me, but gummy bears do (see above). So being able to trade makes the difference between enhancing my wealth and not-enhancing my wealth.

LikeLike

Georg Thomas March 27, 2018 at 12:19 am

Georg, I didn’t say that “wealth is what your accountant or the IRS tells you what it is”. I said nothing of the sort.

I said that both the IRS and an accountant will tell you that trading an asset for another asset doesn’t create wealth.

Best regards,

w.

LikeLike

You write: “Georg, I didn’t say that “wealth is what your accountant or the IRS tells you what it is”. I said nothing of the sort.” You are right. I apologise for misrepresenting your statement.

LikeLike

Georg, you are a gentleman indeed. My thanks.

w.

LikeLike

“I can assure you that trading assets does NOT create wealth. If I give you $100 worth of coffee and you give me $100 worth of tea, there is no wealth created. Ask your accountant, or the IRS, if you don’t believe me.”

I believe the IRS disagrees with you on this one as I think that this was incorporated in the “tax simplification” of the Reagan era (where the tax manual actually increased significantly). As to how they enforce this at the individual level I have no idea (probably just one of those “laws” waiting for someone to trip over). The following is from IRS topic 420 @

https://www.irs.gov/taxtopics/tc420 and there is even a requirement to provide estimated tax payments if knowing in advance.

“Reporting Bartering Income

You must include in gross income in the year of receipt the fair market value of goods or services received from bartering. Generally, you report this income on Form 1040, Schedule C.pdf, Profit or Loss from Business (Sole Proprietorship), or Form 1040, Schedule C-EZ.pdf, Net Profit from Business (Sole Proprietorship). If you failed to report this income, correct your return by filing a Form 1040X.pdf, Amended U.S. Individual Income Tax Return. Refer to Topic No. 308 and Should I File an Amended Return? for information on filing an amended return.”

LikeLike

Thanks, BFL. I fear that you’re confusing income with wealth.

You’re If I give you $100 worth of coffee because I prefer tea, and you give me $100 worth of tea because you like coffee, neither of has increased our wealth. The wealth is created in the growing of the tea and coffee. The amount of tea and coffee, and thus the amount of wealth, has not increased just because the owners of the tea and coffee are now different … that’s just a change in ownership, not an increase in wealth.

In addition, in this instance, in addition to no wealth being created, there is also no income from the transaction. Now, if I trade you $75 worth of coffee for $100 worth of tea, then I have to report $25 in income to the IRS, “barter income” as they say above … but again, despite the income, no wealth has been created. We know this because the total amount of coffee and tea is the same before and after the trade.

Again I’d point you to a Ponzi scheme to illustrate the difference between income and wealth. Yes, the starter of the Ponzi scheme has made money, but that’s a zero-sum game. For everyone making money, someone is losing money, and no wealth is created in the process.

The wealth was created in one of the three ways I listed above—you can grow wealth. Someone grew the coffee and grew the tea, and as a result, there was more coffee and more tea in the world. That is the wealth, the stuff you are trading.

But me trading coffee with you for tea doesn’t increase the amount of either tea or coffee, and thus no wealth is created.

Not only that, but even if I make a profit on the deal and have to report income, there’s still not any wealth created—after the transaction, the amount of tea and coffee is still the same.

If this doesn’t clarify it, ask more questions, make more statements … it’s how both you and I learn.

Best regards,

w.

LikeLike

Oh I agree with what you say about wealth. My (not very clear point) was that the IRS rule was added to also cover “apparent” profits-not wealth (as your reference mentioned concerning the IRS). I believe that they expect one to report for gross income (via IRS article) the estimated “profit” difference say between a haircut traded (bartered) for a dental crown. And I was also trying to point out the absurdity and pettiness of this, especially considering the cost of any attempted enforcement. This rule compares with the insanity/inanity of having marijuana scheduled as a level I drug along side heroin by the DEA.

LikeLike

The problem with the example is that the “value” of both the tea and coffee being traded are $100. That is only true at one point in time and space. The argument doesn’t take into account supply and demand. If I’m in Ceylon tea might be cheap because there is an overabundance of it, whereas in England, where the demand is high, the price would be much higher. So moving the tea from one part of the world to another doesn’t create any more tea but the “value” rises and creates wealth.

LikeLike

Bear April 19, 2018 at 4:03 am

Thanks, Bear, but you are conflating value and wealth. Suppose I have an old toy, and I run into an old toy collector. He thinks it is worth a thousand bucks, and pays me the $1,000 … yes, there is value, but once again no wealth has been created. We still just have an old toy, regardless of the price (value) that you put on it.

Think about the old joke. Three guys wash up on a deserted island … and within two years they’ve become rich off of the profits made by trading sand with each other. Lots of value, but zero wealth created.

The wealth is created when humans have something that they did not have before. In the case of the coffee and tea, wealth is created when the coffee or tea is grown. Before, no coffee. After, coffee. That’s wealth.

But when coffee and tea are traded, no matter what value each party might put on the trade, nothing new is created. At the end of the day we still have a hundred pounds of coffee and a hundred pounds of tea. One guy might think he got a great deal. He says to himself, “This tea I paid $100 for is worth at least $150.” And he might sell it to the next guy for $150.

But that does NOT mean that $50 in wealth is suddenly created. There’s still a hundred pounds of tea, you have $50 more … and the buyer has $50 less. No net gain.

Best regards,

w.

LikeLike

@Willis Thanks for responding

Maybe we’re lacking some common definitions. If I’m understanding your position, wealth is the creation of things of value. So the creator of the toy created “wealth” but if someone buys it and later sells it to the collector no new wealth was created, regardless of the value at that point in time? So how do you determine what amount of wealth is inherent in the toy? Can’t be based on the dollar value when the original creator sold the toy because he could have also sold it to the toy collector directly and received a larger amount for the same effort and materials. Conversely, if no one wants his toy then there is no value and therefore no wealth and you could argue negative wealth because resources were wasted. So nothing that is created that has no utility creates no wealth regardless of the value place on it?

Good joke, but I would argue there is no value in the sand, to them at least, because there is no utility and an oversupply of the item where they are. Consider that Saudi Arabia imports sand. So moving sand that has no worth where it is to someplace where it does, while it is not a direct creation of wealth, is necessary to that final creation of something so some of that wealth accrues to the company that moved that sand.

If I follow what you’re saying, the more coffee I create the more wealth I have created, but if no one drinks coffee where’s the wealth as I understand the term? However, if I can move it to somewhere where people drink coffee have I created wealth? One place it rots in the warehouse, in the other I can exchange it for something I want. There’s value created but can there be wealth without value?

regards

-B

LikeLike

A trade war will impoverish all the countries (or rather the citizens of those countries) that engage in it. A trade deficit is matched by capital account inflows. In a typical year foreigners take about $500 bn of what they earn selling goods and services to the US and use those dollars to acquire US assets. In other words the US has a capital account surplus. Total trade always balances. This inflow of foreign capital provides finance for capital creation and business investment and thus a more dynamic and prosperous economy. If you place tariffs on imports you are punishing your own consumers as well as US manufacturers that incorporate imported materials into their products. It is worth noting, by the way, that the trade deficit is a tiny proportion of US wealth which is approx $95trillion. Furthermore the total net worth of US household wealth increased by $2.3trillion in the first quarter of 2017. So even at the rate of €500bn foreigners are getting an even smaller percentage of ownership of the US. And that’s just household wealth. A trade deficit is nothing to worry about – it generates investment and wealth. To deliberately reduce it by import tariffs is to cut off your nose to spite your face.

LikeLiked by 1 person

Richard, the investment back of funds for US assets means you are selling your future, since you have to eventually pay the investment off. You end out living in property owned by another country, and pay the price they demand for goods in companies they own. They will demand enough wealth transfer to raise their own country economy, and lower ours. We will lose many jobs and standard of living.

LikeLike

Richard, you might consider it as a business. Suppose that your business buys more than it sells in total, as the US is doing vis-a-vis other countries. How long will that business stay in business?

You say it’s OK because foreigners are buying the assets of the business … how on earth does that help? The business will go down the tubes whether the foreigners are buying the assets of the business or not.

w.

LikeLike

There never was free trade except in the minds of US globalists.

A personal example from a guy who was on a small consulting team tasked with either ratifying (aka CYA) or opposing (aka get fired but only after board is forced to let shareholders know the real deal) the board decision to shut down Harley Davidson in the late 1970’s motorcycle wars. I drew the short team straw and spent months in Japan with a translator figuring out their offense. Now, one defense idea was to start selling Harleys in Japan (heck, the Yakuza loved them) to price pressure the high end of Honda, Yamaha, Kawasaki, and Suzuki. Ah, those ‘samurai’ saw the trade counterthreat, and got the Japanese government to pass a new motorcycle license law requirement—‘perfectly reasonable on public safety grounds’. New special license to ride any motorcycle over 750 cc (the ‘big bike license’). Only one extra driver requirement to get it. Lay the big bike down on its side, then pick it up again, mount, and ride. You ever tried that with a Harley? Especially as a short stature Japanese?

Now the ‘free trade’ con was this. Honda’s 750 cc bikes weighed as much and had MORE horsepower than Harley’s 1000 plus CC machines. The engines are fundamentally different. Honda was overbore high RPM, Harley was overstroke low RPM (low wear high reliability like WW2 airplane engine designs given that eras manufacturing precision capabilities). So Japan created an artificial non tariff trade barrier based on an engine design choice difference. Simple fact: At that time Japan had no models over 750cc and Harley had none under 1000cc

Trumps bilateral reciprocity idea means the US would have slapped a similar license requirement on all Jap motorcycles with, say, HP greater than 60 (the then Harley 1000 cc Sportster number). Meaning all of their 750cc models. You see, overstroke designs have enormous low rpm torque so don’t need as much horsepower as gotten at high rpm. Anyone whomtoday listens to the Jap screaming crochrockets versus a rumbling Harley Hog gets this intuitively.

To finish my Harley story, the conglomerate Board owning Harley did NOT accept our recommended plan to stand and fight, and did fire BCG. But the Harley management that believed us and with whom we had worked for almost a year did a leveraged buyout based on executing our plan, which had three basic parts: 1-get ITC antidumping duties (the Jap samurai were selling in the US below cost, my personal fact contribution and ITC testimony) for 5 years, 2-use the 5 years breather to fix major quality and obsolete manufacturing issues that were more management than capital investment, 3-sell the hell out of that overstroke low rpm Harley rumble that the Jap bikes could never copy. The rest is now history.

So, a personal anecdote in support of Willis’ general but more abstract point.

LikeLiked by 2 people

Free trade is superb but it all hangs on the exchange rate and the hidden trade barriers.

Rist you have the hidden trade barriers well covered the power to show a subsidy or regulatory advantage should be enshrined in every agreement.

The exchange rate is a big issue and any action that distorts the relativities should be rewarded with an equivalent universal factor import tax or duty.

One note of caution the US is a huge subsidizer of agriculture and industry it would be massively advantaged if this was removed and replaced with direct controls to eliminate the distortions in play.

As a New Zealander we experienced the removal of all subsidies and the economy expanded massively the one bug I have is that exchange rates are distorted and only the US can influence this. Germany have an undervalued euro to play with and it has decimated a vast portion of the planets industries.

Always be mindful of the “gain from trade theorem” however.

LikeLike

Not just undervalued Euro. German industry is also helped by low pay/high productivity ratio and even more by the low costs of borrowing from banks as compared with other Eurozone countries.

LikeLike

Willis

Your definition of wealth is too narrow. You are limiting it to the necessities of food and shelter in the context of a primitive Robinson Crusoe economy. In modern economies services make up a much higher proportion of GDP than manufacturing. Approximately 80% of US GDP comes from services. This is broadly in line with other advanced economies. In Singapore, a tiny country of few natural resources, services are 75% of GDP and agriculture is zero. Yet it is one of the richest countries in the world with a GDP per capita approaching that of the US – thanks to trade.

A movie has value but does not put food on the table or provide shelter. I willingly pay for a haircut or visit the doctor because their services have value to me. I listen to music and rad books even though they only feed me spiritually. Is this not true wealth?

LikeLike

By way of supplement:

(1) By equating subsistence level production with wealth — and limiting the term “wealth” to that meaning — we would not be able to recognise a difference between US-citizens (who survive) and citizens of Sudan (those, who survive) — they are both wealthy by virtue of being able to survive. It is not a trivial matter that the wealth difference is in actual fact gigantic and matters tremendously from the point of view of humanism.

(2) Erik Reinert explains in his excellent book how less developed countries can get trapped as eternal low-value-added producers in a comparative advantage world of free trade, requiring protectionist measures to develop and shore up high-value-added domestic industry. I tend to agree with this position. The matter is different with highly developed countries.

However, if we are committed to free trade, we have got to be honest about it. The US-administration is right to call us — hypocritical Europeans — on being the more egregious protectionists.

LikeLike

Richard Smith March 27, 2018 at 1:08 am

Thanks, Richard. Hey, if you want to live on an island with nothing but barbers, bankers, and accountants, it’s up to you … but you’ll soon find out that they don’t create wealth, and you’ll starve to death.

Look, I’m not saying that services are unimportant. As I said above, sometimes they are life and death … but they are not creating wealth. And yes, an island like Singapore can exist with 75% services and no agriculture … but only if they have access to people who are actually creating wealth. Without the wealth creators, Singapore wouldn’t exist.

Think about it. Suppose everyone in the world, not just Singapore but the world, was simply providing services and had no agriculture or extraction … how long before everyone starved?

Regards,

w.

LikeLike

My definition of wealth, (see above):

“The essence of wealth is the ability to satisfy a desire (at one’s discretion). The successful fulfilment of a desire may be classified as a gain, a benefit or an advantage vis-à-vis a state of affairs, when no such fulfilment has been accomplished.

By extension then “creating wealth” refers to an act that provides one with “a gain, a benefit, an advantage” ( i. e. results of the fulfilment at one’s discretion of a desire/desires).”

If my definition of wealth is acceptable, then you are factually wrong in claiming that only products derived from activities ensuring basic survival may count as wealth. (Also, you are needlessly burdened with the obligation to list – if called upon to do so – what activities/products count as being able to ensure basic survival ( = wealth).

Further, there is no practicable or indeed sensible way to disentangle wealth-as-subsistence from wealth-in-non-subsistence-form in a modern economy with a very intricate and deep division of labour and roundabout ways of production (even on the subsistence level).

Wealth in modern society is precisely characterised by the fact that very few people engage in ensuring subsistence, with the majority involved in non-subsistence activities whose provision is key to their being able to survive at the level of basic needs. Also, these non-subsistence activities keep improving, even revolutionising the way in which we ensure basic survival (engineers don’t grow potatoes but they greatly improve the products quality and level of output).

We fare better in acknowledging wealth creation in all its forms and ramifications, instead of privileging some activities as being capable of producing wealth while leaving others out of the picture.

LikeLike

And commerce only works if there is a surplus of something that is desired by someone else who also has a surplus that is desired and so on. Consider your islands but lets say one has an abundance of coal but is hot and the other has fish and is very cold. The first one is starving and the second one is freezing to death. Along comes a sailor with a ship and sees the situation. He takes a load of coal to the second island and trades for the fish who he takes back to the first island and continues trading between the two islands. Of course he needed some trade goods to get the coal in the first place, or credit from the coal island people(enter banking). In essence the coal and fish weren’t worth very much to the people who had them since they had an overabundance but lacked some other necessity. By moving the goods to another place did he create wealth? They were certainly more valuable when they were moved (but only to the people that were lacking them). Services (not all but some) may not create wealth directly but they do leverage that creation.

LikeLike

By way of supplement: whether we grow wealth, extract it, manufacture it or realise it by trade/exchange or theft, every form of wealth depends on preconditions antecedent to growth, extraction, manufacture, trade/exchange or theft. Growing wealth, for instance, presupposes a host of physical, biological etc. preconditions. So, the fact that most wealth realised by exchange or theft has further necessary prior conditions (such as the earlier production of the wealth to be realised by exchange or theft) is not unique to trade as a wealth creator. In fact, in a society with a high degree of division of labour growth, extraction or manufacturing will not suffice to ensure the realisation of wealth. Trade will have to do the trick.

LikeLike

To put it differently: capitalism runs on sales.

LikeLike

Georg Thomas March 29, 2018 at 9:28 am Edit

Two points:

First, when I was a kid, our foreign trade was about zero … and the country was flourishing. So the idea that we must have trade doesn’t pass the historical test.

Second, I have no problem with foreign trade … as long as we sell manufactured goods and import raw materials. Doing it the other way around, as we are doing with China, is hugely damaging to our economy by moving our manufacturing, the main way to create wealth, offshore …

That’s just foolish.

w.

LikeLike

@Willis

We’re about the same age so I remember when “Made in Japan” was a joke. Then the 70’s and 80’s came along and they started cleaning our clocks with imported cars, cycles and electronics while blocking our exports to them. Just like you’ve been talking about.

I don’t see the problem as trade per se, but non reciprocal trade. What’s going on now is they export goods to us and we give them paper (actually it’s electronic equivalent, which is just fiat money)or sell them raw materials. If the overall trade doesn’t balance out then those dollars will come back to haunt us. The Japanese went on a buying spree with those dollars and bought up a lot of our real estate and businesses. Sony pictures, Rockefeller Center to name two prominent ones. The Europeans are doing the same thing: Breweries and Supermarkets are two that I’m aware of. I think trade is good but it’s got to be equal.

LikeLike

You may produce as much goods and services that potentially represent wealth, if you do not act to realise that wealth, there will be no wealth available. In modern societies like the USA, wealth is mostly realised via exchange. Not even (most of) the few who produce our food and clothes (and other basic needs) are autonomous producers, having instead to realise whatever wealth will be available to them eventually via trade/exchange. The quality of our basic and non-basic goods and services would be considerably lower and we could sustain only a fraction of today’s populations, if we abandoned trading with one another and regressed to forming communities of autarkic households. Trade is an indispensable condition of wealth in our society. This holds true irrespective of how one assesses the US’ current account, the US’ terms of trade with other countries or which kind of foreign trade policy one favours.

LikeLike

Willis I enjoy your great insights, particularly with regard to the climate, but your views of trade make you a mercantilist, a view which eventually was discarded by the British, an island population with not much in the way of natural resources other than coal, and as a result they became the leading commercial country in the world thru trade. The US has run a trade deficit since the 70’s, during which time the wealth of the country increased dramatically. Regarding employment, we have almost record unemployment now. The greatest source of job destruction in manufacturing is technological advances. Modern steel production methods allow for the production of the same quantity of steel with a fraction of labor required as compared to the past. Finally Americans are able to benefit from the purchase of inexpensive foreign goods, enhancing the lifestyles of the least prosperous among us. Walmart has prospered from this realization. As a postscript, trade forces existing businesses to become more efficient, adopting more productive methods of manufacturing, etc..

LikeLiked by 1 person

Thanks, Stuart. Read Reichert’s book and get back to me. He lays out exactly how Britain became wealthy using a host of data and examples I don’t have at my fingertips. Short version? Britain did NOT become wealthy by trade.

See the graph above. The net trade deficit went negative in about 1984.

From 1960 to 1984, the economy grew at an average rate of 2.4% per annum.

Since then we’ve run under a trade deficit, and the growth rate has been only two-thirds of that, 1.6% per annum.

And although this seems like a small difference, if we’d continued to grow at the pre-1984 rate, instead of the GDP per capita we have now of $53,400/person, we’d have a GDP/capita of $67,300 … about a quarter more.

And in part, this is because we are sending billions and billions of dollars out of the country each year, as measured by our trade deficit.

Here’s a way to look at the core of the problem. Suppose we got all of our vegetables from Mexico. We send Mexican farmers billions of dollars in exchange. At the end of the year, all the vegetables are eaten … but the Mexican farmers still have the billions of dollars.

Now suppose instead we grow all our own vegetables. We give American farmers billions of dollars plus a few more because the produce is more expensive. At the end of the year, all the vegetables are eaten … but the American farmers have the billions of dollars.

Which way does the US end up wealthier?

This is why Philipp von Hörnigk said in 1684 (emphasis mine):

Best to you, and please, read the Reichert book. As I mentioned above, I was a staunch advocate of free trade until I read it … and then, like the famous economist John Maynard Keynes said, ”When my information changes, I alter my conclusions. What do you do, sir?”

Regards,

w.

PS: You might also enjoy my other posts on this subject, which are here.

LikeLike

George Goodman(aka Adam Smith) wrote a book that always stuck in my mind called Super Money which I no longer have. One of the points he made was that those dollars that went overseas didn’t just come back to the US but were floating around in the rest of the world the way the pound Sterling once was. Something of a replacement for gold because it was considered “safe”. His fear was that if the rest of the world began to mistrust the dollar they were going to come roaring back to haunt us with a major devaluation. Of course they could also be used to buy our tangible goods with money that wasn’t worth more than paper internationally before that happened.

LikeLike

The most important and most fundamental reason why I prefer a fairly broad definition of wealth has to do with the anthropology that I espouse.

My core hypothesis is: man differs from other animals in that he adapts to his environment, survives and thrives by constantly inventing/discovering new desires/needs and constantly trying to fulfil these desires. He never ceases to invent or discover, he never stops attempting to attain a newly conceived benefit (a new element within the arsenal that we call “wealth”). Constitutively, man is a wealth creator— a universal wealth creator, he applies this natural reflex to all aspects of life, not just the part required to ensure basic survival.

That is also why I believe economic growth is a natural extension of the human condition. Man lives and prevails in his environment by permanently going for new solutions, new benefits, new needs. To deny man his universal drive to create wealth — subject to reasonable moral provisos — is to curtail his humanity. Sir Karl Popper puts is well in his phrase: “all life is problem-solving”. And all this problem-solving is driven by the conception of new needs while being directed toward fulfilment of new human desires.

This shows even in trivial events, such as when you have just toppled your tea-pot. Looking carefully at the way you try to improve the situation, you will find that you are developing desires you have never been pursuing before (you try a new place to keep the pot safely or you do something about the working surface in your kitchen or you discover an uneven part at the bottom of the pot and try to repair it etc.) we are constantly working toward gains, benefits, advantages — and that is how we accumulate and maintain wealth.

LikeLiked by 1 person

Here’s an example of the terrible, awful things that can happen when we put on tariffs …

w.

LikeLike

Willis

My last attempt to make one of my heroes see what’s wrong with tariffs.

Let’s start from the recognition that trade is not a zero sum game. The buyer regards the goods as worth more than the dollars paid and the seller rates the dollars more valuable than the goods received – otherwise why trade? So each party has gained. The location of each party is of no economic significance – both parties still gain. You have confused the issue by bringing in the irrelevant fact that a group of consumers in one trading block happen to have a cumulative deficit with another trading block. So what? Each and every individual unit of trade was of benefit to both. Now assume that a buyer’s government places a tariff on the purchase of goods from a foreign seller. The result is a reduction in trade which was beneficial to both parties as well as an enhancement of government power at the expense of is own citizen. Two wrongs. Would you insist in import tariffs if you were representing a US State with a trade deficit with another US State? If not, why not? Presumably you would advise any nation State with a trade deficit to do the same. Result? An insane global trade war with each State endeavouring to achieve a trade surplus with every other. Exactly what the world faced in the days of mercantilism and which Adam Smith, Frédéric Bastiat and David Ricardo inveighed against. Import tariffs will result in a global reduction in trade and thereby a reduction in wealth – particularly that of American consumers.

,

LikeLike

Richard Smith March 28, 2018 at 6:43 am

I think I see the issue. The fact that the buyer regards the goods as valuable doesn’t make the transaction beneficial for the country. For example, if I have a factory in Ohio and there are no tariffs, I can move the factory to Mexico and pay $3 per hour for my workers.

Now, obviously, as a factory owner I gain in the process … but the country as a whole loses badly. It loses jobs, it loses a factory, a town shuts down … so no, Richard, the proper measure is not whether an individual is gaining. It is whether the country as a whole is gaining.

Irrelevant? Not in the slightest. As I pointed out, if we buy our vegetables from Mexico, at the end of the year the vegetables are gone, and Mexican farmers have billions of dollars. If we buy our vegetables from the US, at the end of the year the vegetables are gone, and American farmers have billions of dollars.

Which one is better for the US? Would you rather have those billions of dollars circulating in the US economy, providing jobs for our workers and keeping our towns and communities alive … or have them lost to Mexico? Look at what happened to the Rust Belt when our factories moved south. That’s the result of “free trade”, and it happened just as Ross Perot predicted.

Perhaps you could answer those questions and we could move forwards. However, I cannot recommend strongly enough that you read “How The Rich Countries Got Rich, And Why Poor Countries Stay Poor” before you take too strong a stand on these matters …

My best to you, and thank you for your kind words.

w.

LikeLike

Willis

I have read and admired your many articles on all manner of things, including your first-hand observations on the poor of this world, and so I am a little surprised by the US-centric approach in your article. I’ll come to that point later.

You blame the existence of the rust belt on foreign competition. But as Thomas Sowell has pointed out Toyota and Honda employ thousands of US workers – but not in the rust belt where jobs have been destroyed by rapacious State and local government, red tape and union militancy. Liked the UAW, the unions in the steel industry and other industries have piled on costs to the detriment of those industries and the US economy as a whole. Now they are to be protected at the expense of US consumers. (See how the DowJones responded to the news.)

Competition from within and outwith a country forces higher cost producers out of business to the detriment of their workers. No doubt about that. The question is whether the consumer and efficiency savings create new jobs. In the opinion of the economists who have studied the data, the gains outweigh the temporary dislocation. See, for example, Greg Hankiw’s aricke in the NYT (Why Economists are worried about International Trade, Feb 16, 2018) in which he refers to research by Frankel and Romer (of Harvard and the University of California respectively) which concluded that ‘a rise of one percentage point in the ratio of trade to GDP increases income per person by at least half a percent (allowing for geography and other confounding factors).

Now to the point I alluded to at the beginning. What about the poor Mexicans? Your support for protectionism is, by definition, country specific. Presumably if you were a German you would support the huge tariff that the EU (a protectionist block – which is partly why I voted for Brexit) imposes on processed coffee to protect the German coffee industry at the expense of poor coffee-producing Africans. Happy with that? If you were a Mexican you would protest at tariff walls that keep out cheaper Mexican imports and which could employ Mexicans desperate for work at a measly $3 ph. Whatever basis you believe there is to protect US jobs it is at the expense of poorer foreign workers and every other rich country can say, bugger everybody else (UK slang , sorry) we’re shutting them out. Result – trade war and everybody loses.

Richard

LikeLike

Richard Smith March 29, 2018 at 5:47 am

I cannot do better than to quote Philipp von Hörnigk said in 1684

I fear that the US cannot be the support of every other country … what about the poor Bolivians, or the poor Bhutanese? Sorry … they have to look out for their own country.

Right now, we send a criminal amount of money to Mexico every year, and have done so for a quarter of a century … you seem to think that we should continue to impoverish ourselves at the expense of the Mexicans, which seems quite crazy to me.

w.

LikeLike

“I fear that the US cannot be the support of every other country … what about the poor Bolivians, or the poor Bhutanese? Sorry … they have to look out for their own country.”

Granted. But hopeless. I happen to know something about Bhutan, a Least Developed Country at present. They survive by LDC aid from the UN and a working relationship with India. With less than 800,000 people and few resources (they sell hydro power to India) and a strong desire to hold on to their traditions and values, they are in a serious pickle. And the UN has told them that they will be “graduating” out of LDC, and with that they lose a lot of aid money. The future is very uncertain. Which is sad, since they are a good people and have an honest government.

“Right now, we send a criminal amount of money to Mexico every year, and have done so for a quarter of a century … ”

Speaking of sending criminal money to Mexico, how much drug money gets sent there? The odd thing is that it doesn’t seem to benefit the people of Mexico. Whereas the money we send to China and Japan sure made a lot of millionaires there, who then buy businesses and property here. (not saying that’s good for us)

LikeLike

– And Willis is exactly right. The U.S. must look after itself first and foremost – and fair trade is the basis of that; you want to trade $Umpty-Million of your goods with us? Then take $Umpty-million of ours.

I’m Canadian, and a lot of us are flapping-in-the-wind over NAFTA; but I see it for what it is. ALL free-trade agreements with the U.S. are to gain access to U.S. markets for our products – and therefore, to move U.S. jobs here. That works up-to-a-point, but ONLY up-to-a-point; and we’re well beyond that, the U.S. is bleeding money (tax dollars their unemployed workers would otherwise be paying them) into our coffers.

I humbly posit the U.S. can’t afford to do that anymore. Two BIG reasons are Russia and China; they’re both hungrily eyeing the “World’s Only Superpower” slot and licking their chops. We’re far, far better-off with Uncle Sam in the saddle than we’d be with Uncle Vlad or Uncle Xi, but it costs Uncle Sam a HUGE amount of money to stay up there; and we’re not trading reciprocally, so we’re not paying our share of it.

So I say (FWIW), Trump is right; and the U.S. would be well within both common-sense and its rights to tear-up all its free trade agreements. They’re all to make it easier for us to sell our products there; and without reciprocal trade (which won’t happen – yeah, we buy all our cheap cr@p from China too), it’s to the U.S.’s advantage to slam the door on us and go back to making their own.

And what benefit is there for the U.S. to care about us, in this matter? That’s right – none. Sorry; this is poorly thought-out, and poorly-worded.

LikeLike

“When a company can move a factory to Mexico and pay their workers $3 per hour with no workmen’s compensation insurance and no tariffs when they sell their goods in the US, why not?”

This is true as far as it goes. But if American companies need to offer higher wages to get people to produce the same goods, that is because they are in competition with other American industries which can outbid them for labour. Japan and Korea used to undercut US manufactures in this way, but not any longer because their own hi-tech industries have taken off. Tariffs are the equivalent of a tax on the American consumer: they will create customers for some American industries by taking them from other industries which it would be better to have. They are always, always introduced for the benefit of old industries, never new ones. Only innovation can keep a rich country ahead and it is better to let the old industries go.

LikeLike

Willis I’m stuck. I’ve been a bit queasy about your tariff stand since you first introduced the subject. So, if I disagree with you I’m usually wrong. If I disagree with Ron Paul I’m usually wrong. Apparently I’m wrong a lot but I’ve been reading Ron Paul longer than I’ve been reading you so I’m biased. The money “raised” by tariffs gets sucked into the non-productive governments so it’s hard to see where the people’s economics win.

http://www.ronpaullibertyreport.com/archives/trump-on-tariffs-punish-china-by-taxing-americans

LikeLike

The purpose of the tariff is not to have a tariff but to make trade fair. If other countries remove there tariffs, we can also and trade is fair. There would still be some in-balance due to lower labor cost, but added shipping cost and less quality control partially balance that out, and countries that can compete well eventually have higher labor cost also.

LikeLike

Leonard Weinstein April 12, 2018 at 5:43 pm

So your claim is that under NAFTA, with no tariffs, things were fair? When thousands of companies moved their factories to Mexico because they could hire workers for $3 and no workmen’s comp insurance, causing massive unemployment in the Rust Belt with entire towns closing down because their factory left town, that was fair? When thousands and thousands of American workers lost their jobs to Mexicans, that was fair?

Leonard, I gotta say … you have a very, very different idea of what is “fair” than most people have.

NAFTA and the removal of trade barriers have been great for Mexico, and great for US corporations who moved operations to Mexico. Yes, the US rich have gotten richer, but for the US worker and for US factories and US factory towns, it has been an unmitigated disaster. Bad news, my friend … that’s not “fair” on any planet.

w.

LikeLike

Willis, Thx for a very well written article which is clear and distinct. Having worked in engineering my whole career, I am well aware that I was part of the SERVICES sector. I was constantly reminded of that (that I was essentially overhead) in spite of my role in saving the company countless $$ in avoiding making costly or catastrophic decisions. I accepted that fact – that I was not a part of operations (manufacturing) or sales… selling a product or service. Never the less, I was shocked, amazed that for the past 20-25 yrs both Republican and Democratic parties were ignorant as to what creates wealth for the U.S., and bought into this idea of globalization. By agresssively encouraging U.S. companies to relocate manufacturing plants overseas it makes products cheaper for the consumer to buy, but impoverishes the U.S. populace by eliminating manufacturing jobs. It is essentially selling your economy – your way of life for a MESS of POTTAGE.

At first I thought this might be an agreement between both (Rep & Dem) parties that this would be a socialization process that would elevate the 3rd world economies to quasi U.S. standards. In other words, we would diminish our economic success to benefit/boost the 3rd world economy & socialization process.

Having lived in the 3rd world for over 20 yrs., I have seen the results 1st hand. The countries in which I worked considered that U.S. as extremely naieve as far as industrial economics. They were literally laughing all the way to the foreign exchange bank.

Can we recover our manufacturing base? It will be an extremely long-hard struggle. It is definitely NOT an EASY process. First there has to be a willingness to engage. I haven’t seen that willingness yet. I’m hopeful, but as always- I’m realistic.

A culture that’s adicted to services has a hard time devolving to a manufacturing/production mindset & mentality.

LikeLike

“Everything else is services—bankers, barbers, bookkeepers, surgeons, stylists, singers. They are important, some are life-and-death important … but they don’t create any wealth.”

NOT TRUE

Wealth also consists of knowledge,

skills, best practices — some wealth

is invisible — when you need a surgeon,

his or her wealth of knowledge and

experience, is more important than

wealth that is visible, like a TV.

I wrote an article on trade

in my April May economics newsletter

just after the 25% steel and 10% aluminum

tariffs were announced.

Here is the SUMMARY portion:

A COMING TRADE WAR ?

Summary:

As a libertarian, I favor free trade. But free trade does not exist on this planet. The US has been the least protectionist large economy in the world, and the most open market for imports. The average US tariff on imports is unusually low compared with other nations. The US favors open markets, and we set a decent example, although there have been exceptions. But being the most open market for imports is virtue signaling … it really means other nations are taking advantage of us.

President Trump is an unusual politician. He seems to be doing something ‘professional’ politicians seldom do — he’s attempting to fulfill his pre-election promises. Even promises that could start a trade war. The hysteria over Trump’s 25% steel and 10% aluminum tariffs seemed excessive, in my opinion. Democrats seem to get hysterical after every Trump proposal, as soon as they find a media person with a camera! But a lot of Republicans got hysterical about the tariffs too.

China is the most protectionist large economy in the world. President Trump aims to change that. That’s a worthy goal. But the new steel and aluminum tariffs barely affect China. And the Secretary of Defense said they were not needed for national security, which was the justification claimed by the Commerce Department, in two huge reports.

If we are to risk starting a trade war, our first shot should have been a rifle shot aimed at a specific Chinese barrier to US goods. Instead, we had a 360 degree shotgun blast aimed at everybody in the world, except Canada and Mexico (at least during NAFTA renegotiations, maybe not permanently?).

Trump knows we have something of great value to foreign manufacturers: We control access to the largest market for manufactured goods on the planet — the US. A trade war, even if involving ONLY China and the US, could be serious enough to halt global growth. So far, US investors do not seem to be anticipating a trade war, or they don’t care (but they should).

My economics blog:

http://www.EL 2017.Blogspot.com

LikeLike

Link didn’t work.

so I’ll try again:

http://www.EL2017.Blogspot.com

LikeLike

Richard Greene April 2, 2018 at 8:32 am Edit

Richard, I refer you to an example that I’ve used several times, viz:

Yes, surgeons are important. Life-and-death important. When you need one, as you point out, it is more important than a TV. And librarians are guardians of the knowledge that you claim is wealth.

But if you want to live on the island with the barber, the surgeon, the librarian, and the musician, your life will be very short despite having a doctor on the island … because you won’t have anything to eat, anything to wear, or anywhere to live.

Look, I’m not dissing knowledge or surgeons. I’m just making a clear distinction between the means of production of wealth and other occupations.

w.

LikeLike

Let me attempt to reconcile these two apparently different views. Wish me luck. And I won’t mention the island where everybody survives by taking in each other’s laundry.

On one island lives a surgeon, all alone. His “wealth” doesn’t make him rich.

On the other island lives a fisherman, all alone. He gets by until he gets sick.

The fisherman agrees to trade some fish for some health service.

How is that different from one island only grows potatoes and another island only grows meat and they agree to trade their surpluses? Wealth consisting of knowledge is only a potential wealth; it becomes real wealth when you can sell it or trade it for something you value. Bear and Georg Thomas said as much above.

“Services don’t create any wealth”. True from one point of view. The sports star or the rock star collects millions for their services, so they get rich, but they have not actually created wealth, they have just shared in the wealth of their fans. And if those fans happen to be abroad, then they have brought dollars into the country, so maybe they did create some wealth. If you write a book or a song, you have created something, and if there are others who want it, it can be sold, so it is at least a virtual product if not an actual product. If I collect shiny rocks I find, I can sell them, but I did not create the rocks. No more than the fisherman creates the fish. Economics is all relative.

It gets worse. Billions got spent on Bitcoins, which had zero intrinsic worth. Some got rich — from collecting the money of others. The problem with China is not trade, it is unfair trade.

LikeLike

(1) You write: “To understand this, suppose there are two couples on a tropical island. One person fishes, one has a garden, one gathers food and building materials from the forest, one makes clothes from local fiber. They could go on for a long time that way, they are creating real wealth.

But suppose on the next tropical island there are two couples, and one person is a barber, one is a surgeon, one is a librarian, and one is a musician—noble occupations all but services all … that society will have nothing to eat, nothing to wear, nothing to keep them from the rain. Those occupations don’t create wealth, while the activities on the first island all do.”

Link them via trade and the problem is solved. And all are wealthier.

(2) Once again: You may produce as much goods and services that potentially represent wealth as you like, if you do not act to realise that wealth, there will be no wealth available. In modern societies like the USA, wealth is mostly realised via exchange. Not even (most of) the few who produce our food and clothes (and other basic needs) are autonomous producers, having instead to realise whatever wealth will be available to them eventually via trade/exchange. The quality of our basic and non-basic goods and services would be considerably lower and we could sustain only a fraction of today’s populations, if we abandoned trading with one another and regressed to forming communities of autarkic households. Trade is an indispensable condition of wealth in our society. This holds true irrespective of how one assesses the US’ current account, the US’ terms of trade with other countries or which kind of foreign trade policy one favours.

(3) I don’t think you are right in reducing “real wealth” to activities and goods that ensure basic survival (see my explanations in earlier comments). If wealth of the basic-need-fulfilling-type can be shown to have the same features as wealth of the more-than-just-basic-needs-fulfilling-type, it is factually wrong to equate wealth = subsistence, as you do. Wealth is our ability to fulfil human desires at our discretion. And it is patently wrong to claim that human desires are confined to basic needs and that wealth creation (= the ability to fulfill human desires at our discretion) is confined to fulfilling basic needs.

As I have written above, human beings differ from other animals in that they are wealth-creating machines, they survive, adapt to their environment and thrive by creating and enhancing wealth constantly, far beyond basic needs. This fundamental human trait does not suddenly evaporate when basic needs have been fulfilled. Restricting (the ability to create) wealth to (the ability to fulfill) basic needs is to truncate human nature, denying its true richness.

Wealth in modern society is precisely characterised by the fact that very few people engage in ensuring subsistence, with the majority involved in non-subsistence activities whose provision is key to their being able to survive at the level of basic needs. Also, these non-subsistence activities keep improving, even revolutionising the way in which we ensure basic survival.

LikeLike

YMMV April 2, 2018 at 9:35 am

First, YMMV and Bear and all, thanks for your comments.

Next, YMMV, at the start of your story, we have two healthy people and one fish.

At the end of the story, we have two healthy people and one fish.

Explain to me again about all the wealth that the surgeon has created …

w.

LikeLike

You write: “YMMV, at the start of your story, we have two healthy people and one fish [sic].

At the end of the story, we have two healthy people and one fish [sic].

[YMMV did not say there was “one fish” involved but “some fish”]

Explain to me again about all the wealth that the surgeon has created …”

Well, the fisherman got sick and required a cure to get better. Remember: I define wealth as “the fulfillment of a human desire at one’s discretion”. The human desire was to get well. And the surgeon fulfilled that desire enriching his client or adding to his client’s wealth, as opposed to lacking that instance of wealth, and remaining ill.

LikeLike

Willis said: “…..at the start of your story, we have two healthy people and one fish.

At the end of the story, we have two healthy people and one fish.

Explain to me again about all the wealth that the surgeon has created …”

The fisherman is not the owner of a fish, he is a man who catches fish, and will continue to do so, while he is healthy enough.

Other than that, I’m pretty much in agreement with Willis and Trump (gasp) on this illusion that there is any such thing as Free Trade.

LikeLike

Georg Thomas April 2, 2018 at 12:24 pm

Say what? So if I desire to breathe, and I do breathe, I’m creating wealth? If I desire to punch someone in the nose, and I fulfill that desire at my discretion, I’m creating wealth?

In the context of economics, or pretty much any context for that matter, that definition makes no sense at all. My last job was the Chief Financial Officer for a company with $40 million dollars in sales per year … if you try to run that definition of “wealth” past your accountant he’ll just laugh.

w.

LikeLike

You write: “If I desire to punch someone in the nose, and I fulfill that desire at my discretion, I’m creating wealth?” Of course, I am. Bouncers or policemen create wealth that way. It is another matter, if I can get this sort of wealth-seeking socially recognised. Wealth creation is subject to numerous (social etc.) provisos — which is true with respect to any wealth-creating activities including those relating to basic needs —, but this does not invalidate my broad definition as such. Or can you show me that it does?

You write: “… if you try to run that definition of “wealth” past your accountant he’ll just laugh.”

Well, if you try to convince your accountant — or the IRS, for that matter — that wealth creating activities are restricted to the provision of basic needs … let’s see what reaction you get.

LikeLike

Georg, I didn’t ask about bouncers or policemen. If I desire to punch you in the nose, and I fulfill that desire at my discretion, have I created wealth? Because that is what you are claiming …

In addition, you seem to be confusing making money with creating wealth … they are far from the same. I can make money cutting hair, but that does not create wealth.

w.

LikeLiked by 1 person

You write: ” … you seem to be confusing making money with creating wealth … they are far from the same. I can make money cutting hair, but that does not create wealth.”

(1) From my definition of wealth, which you quote, it is indubitable that I do not confuse (equate) creating wealth with making money — my definition is capable of covering both wealth that is accounted for in monetary terms as well as wealth not so documented.

Of wealth, we may speak, in my classification, when we have been able to attain a gain, a benefit, an advantage, having reached a higher level of satisfaction compared to a situation when the desired gain, benefit or advantage is absent/unachieved.

So if the service of a barber fulfills that condition, lifting you to a comparatively higher level of satisfaction, he is capable of providing you with wealth.

(2) When a bouncer legitimately punches someone’s nose he creates wealth in at least two ways: he achieves a benefit to himself in being able to do the job he is being paid for (here violently but legally fending off an intruder or attacker). And he creates wealth for the person who provides him with income, in that the bouncer ensures the protection from intruders or attackers that his employer seeks. Incidentally, the bouncer’s wealth creation by punching noses can be in fulfillment of a basic need (not to get killed) — which provides us with one more example of why confining wealth to basic needs (which bouncing may not appear to be) involves a needlessly and absurdly truncated definition of wealth. Handling basic needs may be significantly improved by activities that may not be classified as serving basic needs ( — is curiosity relating to aerodynamics a basic need?). Another case: your wealth creating islanders may get into a situation where the only basic, survival ensuring need is to be treated by a supposedly non-wealth-creating medical professional, the surgeon.

Human needs are an intricate and highly dynamic realm with complex interconnections. People constantly find out about what they need or don’t and in what hierarchy these things are to be fitted. Attempts at wealth creation, understood as the search for new and higher levels of satisfaction, are the epitome of human resourcefulness.

To come up with a finite list of wealth-creating (excluding all non-wealth-creating) activities reminds me of the conceit and narrow-mindedness of a command economy where people are directed to engage in “production for use”, based on a central canon that determines which are legitimate and worthy activities and which are not.

And once again: by equating subsistence level production (fulfillment of basic needs) with wealth — and limiting the term “wealth” to that meaning — we would not be able to recognise a difference between US-citizens (who survive) and citizens of Sudan (those, who survive) — they are both wealthy by virtue of being able to survive.

It is not a trivial matter that the wealth difference is in actual fact gigantic and that difference matters tremendously from the point of view of humanism.

LikeLike

Well, I tried. The problem seems to be two words: creating wealth. What is ‘wealth’ and what is ‘creating’.

“confusing making money with creating wealth”. Money is one possible form of wealth, but not the only one.

Compare these two sets of definitions of wealth (and who knows how many more there are).

Business, three kinds:

http://www.businessdictionary.com/definition/wealth.html

Indian guru, eight kinds:

https://www.wisdom.srisriravishankar.org/8-types-of-wealth/

I won’t say that any of them are wrong; but they are not the same thing.

Cutting hair, or providing a medical service, does not create wealth, it just redistributes the existing wealth.

Whether you get money or barter in exchange for that service. You get wealthier or richer, but the total value of wealth in the system does not change. So what can you do to create wealth?